The amount that will be prepaid on your mortgage. The options are none, weekly, bi-weekly, semi-monthly, monthly, yearly and one-time payment. This total interest amount assumes that there are no prepayments of principal.

MORTGAGE CALCULATOR EXTRA PAYMENT ONE TIME FULL

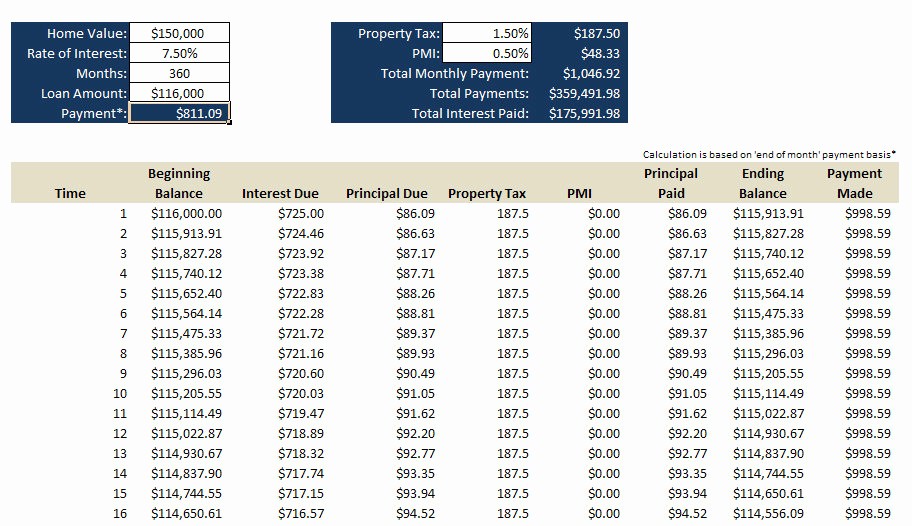

Total of all interest paid over the full term of the mortgage. This total payment amount assumes that there are no prepayments of principal. Total of all monthly payments over the full term of the mortgage. Just like the accelerated weekly payments you are in effect paying an additional monthly payment per year. The accelerated bi-weekly payment is calculated by dividing your monthly payment by two. The effect can save you thousands in interest and take years off of your mortgage. This additional amount accelerates your loan payoff by going directly against your loan’s principal. Since you pay 52 weekly payments, by the end of a year you have paid the equivalent of one extra monthly payment. We calculate an accelerated weekly payment, for example, by taking your normal monthly payment and dividing it by four. Monthly will have 12 payments per year, weekly 52, bi-weekly 26 and bi-monthly 24.Īccelerated weekly and accelerated bi-weekly payment options are calculated by taking a monthly payment schedule and assuming only four weeks in a month. The payment type determines the frequency of payments. Your principal and interest payment (PI) per period.

The most common mortgage amortization periods are 20 years and 25 years. The number of years over which you will repay this loan. Original or expected balance for your mortgage. Registered Disability Savings Plan (RDSP).Purchase + Improvements Mortgage Program.

0 kommentar(er)

0 kommentar(er)