In 2012, the firm closed its third fund valued at $954 million. In 2006, the firm completed fundraising for its second private equity fund, with $850 million of commitments from over 40 investors. In May 2002, Lightyear closed on its first fund, The Lightyear Fund, with $750 million of investor commitments, approximately $500 million of which came from UBS AG.

The firm has raised approximately $3.5 billion since inception across its four funds. In 2000, Marron founded Lightyear Capital, a private equity firm focused on investments in financial services companies.

Marron served as Chairman of UBS America from 2000-2003. The deal was described as one of the most successful transactions of its time, having reached a record sale price and delivering clear benefits to shareholders, clients and employees of both companies. PaineWebber's sale to UBS AG expanded UBS's presence in the U.S. The deal had the support of PaineWebber's major shareholders. The deal valued PaineWebber's outstanding share capital at $10.8 billion, representing an estimated 47 percent premium over PaineWebber's closing price the day prior to the deal's announcement, and a multiple of 18.1 times the company's estimated 2000 earnings at the time. In 2000, as CEO, Marron engineered the sale of PaineWebber to UBS AG. During his tenure, Marron transformed the business into a leading wealth management and institutional investment firm. In 1980, Marron was named PaineWebber’s Chief Executive Officer, and in 1981, he was named Chairman of the Board of PaineWebber, roles he would hold for the next two decades. In 1977, PaineWebber merged with Mitchell, Hutchins & Co., and Marron was named President of PaineWebber. PaineWebber Group was one of the nation's leading full-service investment firms, serving its global client base through its primary businesses of banking, retail sales, capital transactions, and asset management. The company was sold to McGraw-Hill in 1979 for $103 million. The company went public in 1976, with 52 of the nation's 100 largest industrial corporations as clients. Data Resources is credited with "breaking new ground for the practical use of economics" among business executives and others. DRI became the largest non-governmental source of economic data and, working with Eckstein's theory of core inflation, developed the largest macroeconomic model of its era. with Harvard University notable economist Otto Eckstein. In 1969 Marron co-founded Data Resources Inc. In 2001, the Mitchell Hutchins name was discontinued when it was merged as a subsidiary with UBS's Brinson Partners division. PaineWebber continued to use the Mitchell Hutchins brand until the company's sale to UBS in 2000. In 1977, Mitchell Hutchins was acquired by Paine Webber. In 1975, a national poll of portfolio managers chose the institutional brokerage firm as the “best research house on Wall Street.” Under Marron's leadership, the firm grew to be known as "one of Wall Street's premier stock research firms." was a leading equity research boutique in the U.S., ranked the number 3 firm by Institutional Investor in 1974.

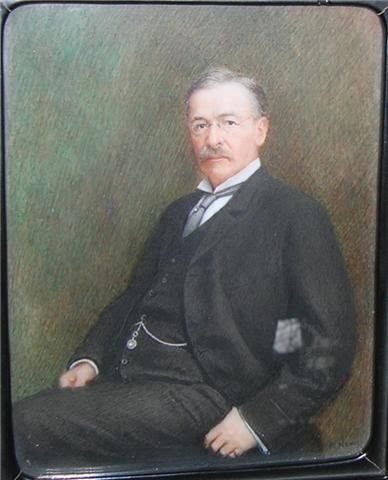

In 1965, Marron sold his company to Mitchell Hutchins and in 1967 was named president of the company. He was the father of the economist Donald B. Donald Baird Marron (July 21, 1934 – Decem) was an American billionaire businessman, investment banker, investor, and philanthropist notable as the chairman and chief executive officer of brokerage firm Paine Webber from 1980 through the sale of the company in 2000, as well as the founder of private equity firm Lightyear Capital and of Data Resources Inc.

0 kommentar(er)

0 kommentar(er)